Blue Energy has initiated a pre-feasibility study for the Bowen Basin southern gas pipeline project, and is in “active discussions” with the Federal and Queensland Governments to progress the project.

The company believes that the fast-start gas fired power generation would unlock 15,000PJ of gas to mitigate the impacts of the east coast domestic gas shortage, and provide flexible, reliable and dispatchable electricity to the North Queensland grid.

In its March 2020 quarterly report, Blue Energy confirmed it has been in active discussions with representatives of both the Federal and Queensland Governments to highlight the need for national energy infrastructure projects to ensure timely and reliable delivery of energy to domestic east coast manufacturers and gas users.

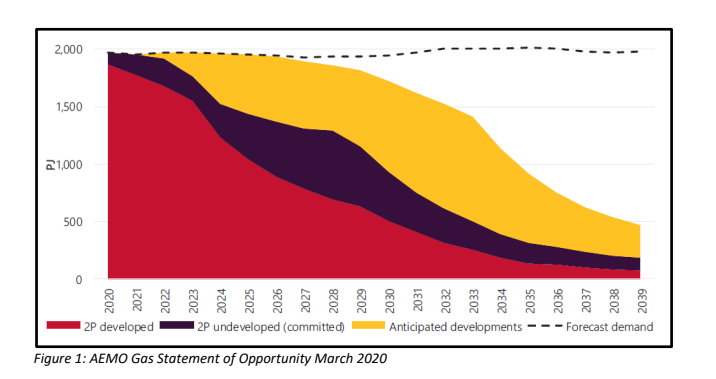

This is in light of the projected long-term east coast domestic gas shortfall commencing in 2023, as identified in the Australian Energy Market Operator’s (AEMO) latest GSOO March 2020 report.

In those discussions, Blue Energy has directed the Queensland Government’s focus to the state’s Northern Bowen Basin as the largest onshore, discovered gas resource that remains undeveloped and unconnected to the east coast domestic gas market.

Arguing that post-COVID-19 “shovel-ready” infrastructure projects will be critical to the national economic recovery, the company proposed that a single multi-user, 500km Moranbah to Gladstone/Wallumbilla gas pipeline would be capable of delivering up to 300 terajoules (TJ) per day of gas to the domestic market and is the most advanced, sizeable gas resource that can be delivered to meet the shortfalls predicted by AEMO.

Government sanction and funding of the line is required to facilitate natural gas and energy field developments in the Northern Bowen Basin.

It is noteworthy that AEMO now forecasts southern state domestic gas supply shortfalls from the winter of 2023 onward, even accounting for the “2P undeveloped (committed)” blocks of gas reserves.

Blue Energy claimed that there was no consideration in the AEMO report of the impact on those “committed” projects to develop those reserves (i.e. required drilling), from the recent dramatic fall in oil price (and hence natural gas prices), and the resultant massive CAPEX reductions made by most oil and gas companies, including all the domestic and foreign major oil and gas producers in Australia.

Furthermore, it claimed that there was even less consideration given in the AEMO forecasts (Figure 1) to the impact of reduced CAPEX on the “Anticipated developments” that underpin the east coast gas supply from 2023.

The company said that failure of any of these anticipated developments to eventuate would leave the southern states in a precarious energy position sooner rather than the expected 2023 forecast.

The onset of the oil price crash and global CAPEX drought in oil and gas expenditure should be a sensitivity addressed in the AEMO forecast, as the east coast gas market is dependent on more drilling (CAPEX), largely by the LNG players, to provide Australia’s domestic gas supply, in the absence of significant dedicated domestic gas activity.

Pre-feasibility work commences on gas pipeline option

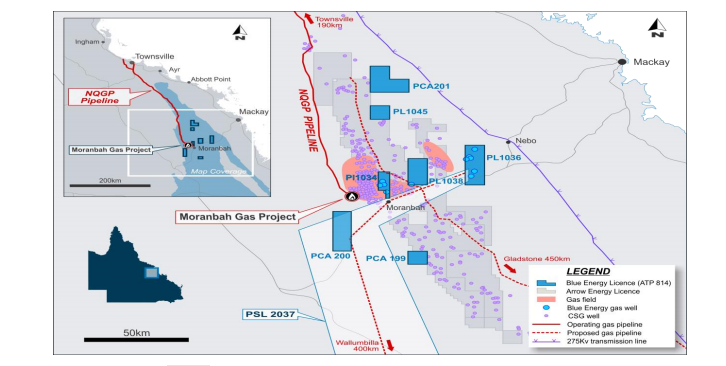

Blue Energy said it was assessing the potential for the development of gas fired peaking generation capacity in certain gas properties within its 100 per cent-owned ATP 814 tenure.

ATP 814 consists of seven disconnected blocks in the Bowen Basin across an area ranging from south of Moranbah up to Newlands in the Northern Bowen Basin.

Specifically, the portions of the permit in close proximity to high voltage electricity transmission and substation infrastructure are most attractive to the company.

This potential project would be in addition to providing natural gas for the southern (pipeline dependent) and northern markets (Townsville).

ATP 814 Bowen Basin Queensland showing PL, PCA and PSL Applications, the NQGP gas pipeline to Townsville and the major High Voltage electricity transmission line between Gladstone and Townsville.

Administrative tenure management matters with the Queensland Government continue with respect to ATP 814, including the four Production Licence Applications (PLAs) and the four Potential Commercial Areas applications (PCAs) lodged by Blue Energy.

Renewal of the underlying ATP is also on foot with the Queensland Government.

These tenure management activities are being undertaken in parallel with the ongoing commercial negotiation and the assessment of each block’s feasibility to host gas-fired power generation projects and gas sales to industrial customers in Townsville or the southern market.

As has been previously advised to the market, ATP 814 currently has 2P reserves of 71 PJ+ and 3P reserves of 298 PJ+, as independently estimated by Netherland, Sewell and Associates (NSAI).

Blue Energy highlighted significant upside within the constituent blocks comprising the permit with a combined 3,248 PJ of Contingent Resources estimated by NSAI.

The broader Northern Bowen Basin Gas Province has a discovered resource of approximately 15,000 PJ of gas which would be sufficient to underpin the East Coast domestic gas market for the next 30 years, based on current market conditions. Blue’s component of this estimate is currently 3,248 PJ+.

Blue Energy maintained that the solution to the ongoing long-term East Coast gas supply shortfall, as Bass Strait declines, was the delivery of more gas supply to the market.

The company said it believed development of the North Bowen Basin gas resource would provide the quickest solution and all that was required was a 500 km pipeline connection.