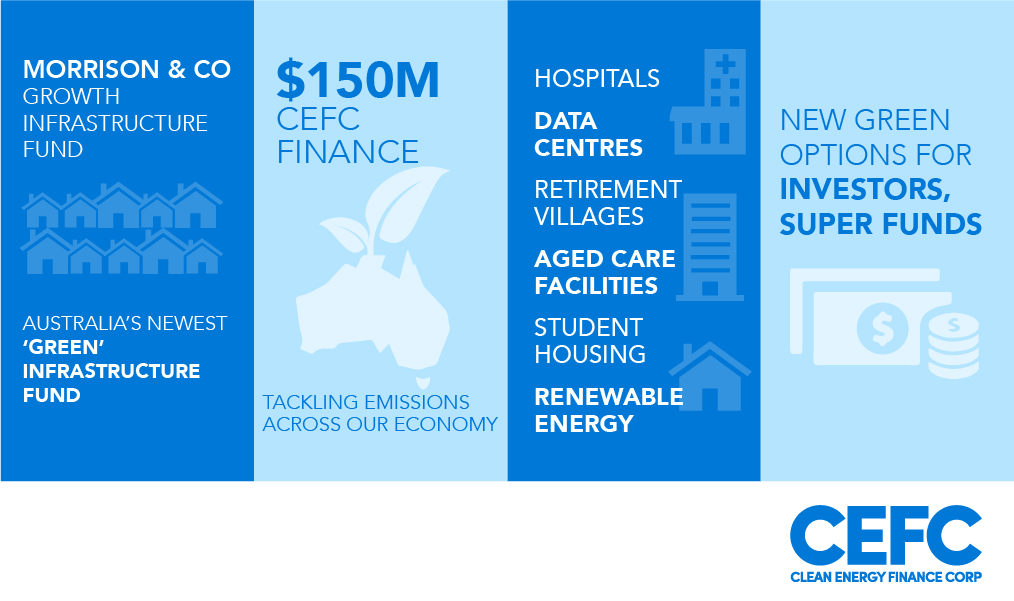

The Clean Energy Finance Corporation (CEFC) and leading alternative asset manager Morrison & Co plan to spearhead clean energy standards across Australian social and economic infrastructure assets as part of a specialist $1 billion ‘green’ infrastructure fund.

The specialist Morrison & Co Growth Infrastructure Fund will acquire and develop a diverse range of essential assets, from hospitals to data centres, retirement and aged care accommodation to student housing and renewable energy.

The CEFC is investing $150 million in the fund, which will acquire and manage a range of assets where there is potential for significant improvements in their energy efficiency profile.

CEFC CEO, Ian Learmonth, said, “This investment is about showing how we can readily improve the way we build and operate our essential economic and social infrastructure. These assets are central to our economy and our wellbeing, and they are built for the long term.

“We see it as critical that new infrastructure assets are built to the highest possible clean energy standards, and that existing assets are updated with proven technologies that can lower emissions and cut energy use.

“We are pleased to work with an industry leader such as Morrison & Co to make this essential sustainability commitment to such a diverse range of social and economic infrastructure assets.

“This will have long-term benefits for asset owners and users, as well as provide a model for other infrastructure investors and owners looking for opportunities to lower their emissions. We have now invested $450 million in major infrastructure projects and programs, to help deliver comprehensive and sustained improvements in the carbon footprint of our infrastructure assets.”

The Australian infrastructure sector accounts for almost half the nation’s greenhouse gas emissions.

Morrison & Co Chief Investment Officer, Paul Newfield, said, “With our fundamental belief in decarbonisation as an investment strategy, we see the CEFC as an ideal partner for this fund.

“Morrison & Co has been investing in renewable energy for over 20 years and we are convinced that applying the decarbonisation and energy efficiency lens to a broader set of infrastructure assets will generate better long-term investment outcomes.

“We are excited to be working with the CEFC to lead the infrastructure sector in this new direction.”

CEFC Investment Funds Lead, Rory Lonergan, said, “The scale of Australia’s infrastructure sector means it is just not possible for one investor to finance the kind of sustainability measures required to make a meaningful impact on overall emissions.

“That’s why it is critical that investors such as Morrison & Co take the lead in establishing specialist clean energy focused investable products. By investing in this fund we are providing other sustainability-focused institutional investors with a new way to tap into this market while also delivering on their own sustainability goals.”

Over time the fund will look to progressively introduce science-based targets to build a zero emissions portfolio. It will also draw on relevant Australian-based sustainability standards to set best-practice sustainability goals, including those of the Infrastructure Sustainability Council of Australia, the National Australian Built Environment Rating System and the Nationwide House Energy Rating Scheme.